Tds deduction on salary calculation

For TDS computation the net salary would be determined as follows So every month the employer would deduct tax at 635 on the salary income and then credit the salary to the. The way TDS is calculated A good way to reduce the TDS deduction.

Tds In Tally Prime Tds Entry In Tally Prime Tds In Tally Erp 9 Tds In Tally Development Entry Power

TDS calculation takes place on the annual income by multiplying the corresponding figure after making a deduction of exemption from gross salary.

. Salary income is charged at slab rate and TDS is deducted by calculating average rate. One can calculate TDS on income by following the below steps. This will usually be equal to your CTC.

An NRI receives different types of income from India. Ad Enjoy Clean And Safe Water In Your Home With Our Water Filtration Solutions. 1 Calculate gross monthly income as a sum of basic income allowances and perquisites.

The employer deducts TDS on salary at the employees average rate of income tax. It will be computed as follows. TDS on Salary Calculator Calculation of TDS on Salary Tax Deduction at SourceIn this video by FinCalC TV we will see how to calculate TDS on salary on mo.

Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. TDS has to be deducted on the estimated income of employee at the average rate of Income-tax computed on the basis of rates in force for that financial year. You need to know all these things so that you have a better picture of the TDS on salary applicable for you.

QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Every Employer who is paying salary to his employee which is more then maximum amount exempt from tax has to deduct TDS on such Salaries Under section 192 of the Income. Secondary and higher education cess.

Average Rate of Tax on Salary Total Tax 100Total Income How to. Total TDS to be deducted. Moreover TDS deduction on salary occurs only after factoring in tax exemptions allowances and rebates and other deductions you are eligible for.

The figure comes from yearly. Note your monthly income and multiply it by 12 to find your yearly income. However if an NRI receives a certain type of income from India then TDS will be applicable to such income.

There is no tax. For calculation of TDS on salary the following are points. The total income tax for the financial.

2 Calculate exemptions under. How to calculate TDS on salary. Now it is very easy.

Essentially the total tax that. Now the average rate of TDS on Salary would be computed as 1326001200000 100 which would equal to 1105. Average Income tax rate Income tax payable calculated.

TDS OF SALARY Estimate Total Tax Liability Period of Employment Calculate tax deduction under section 192. Exemptions Every companys CTC structure includes certain. Here are six easy steps for you to calculate the TDS on salary.

So the TDS to be deducted from the. Consider tax treaties before determining the rate of withholding tax under Section 195. Easily calculate your taxes online for Assessment Year 2023 - 24 FY 2022 - 23 FY 2021 - 22 FY 2020 - 21 with Goodreturns Income Tax Calculator.

The employer needs to calculate the estimated income of the employee and income tax on such income at the applicable slab rate. The TDS will be. TDS is calculated by deducting exemptions and the amount also referred to as deductions from your salary.

Challan 280 Meaning Individuals Who Wish To Pay Their Income Tax Can Make Use Of The Challan 280 Form Form Or Challan 280 Is Avai Income Tax Tax Forms Income

Epf Form 15g Download Sample Filled Form 15g For Pf Withdrawal Gst Guntur Tax Deducted At Source Taxact Employee Services

Challan 280 Meaning Individuals Who Wish To Pay Their Income Tax Can Make Use Of The Challan 280 Form Form Or Challan 280 Is Avai Income Tax Tax Forms Income

Challan 280 Meaning Individuals Who Wish To Pay Their Income Tax Can Make Use Of The Challan 280 Form Form Or Challan 280 Is Avai Income Tax Tax Forms Income

Download Salary Sheet With Attendance Register In Single Excel Template Exceldatapro Attendance Register Salary Attendance

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Prealgebra Activities Real Number System Maze Activities The First Unit Of The Year Is Always The Mo Real Number System Real Numbers Pre Algebra Activities

Get Our Sample Of Employee Payroll Register Template Excel Templates Payroll Template Worksheet Template

Ready To Use Employee Salary Sheet Excel Template India Msofficegeek Excel Templates Tax Deducted At Source Salary

Payroll Processing In India Payroll Payroll Software Payroll Taxes

Pf Deduction Pay Head For Employees Payroll In Tally Erp 9 Data Migration Deduction Data

Epf Nomination Form Online Epf Nominee Update Process Gst Guntur Marital Status Aadhar Card Online Accounting

Star Link A Touch Towards Added Values Payroll Software Biometric Devices Payroll

Tds On Rent Tds On Rent By Individual Huf Section 194ib Gst Guntur Rent Rental Solutions Being A Landlord

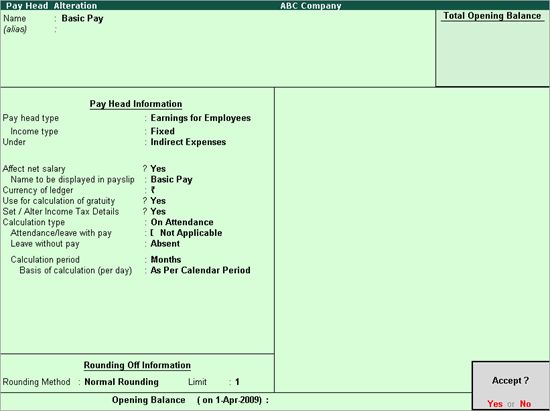

Creating Earnings Pay Head Payroll In Tally Erp 9 Voucher Tutorial Data Migration

File Manager In Eztax In App Filing Taxes Income Tax Self

Creating Pay Head For Income Tax Deduction Payroll In Tally Erp 9 Tax Deductions Income Tax Voucher